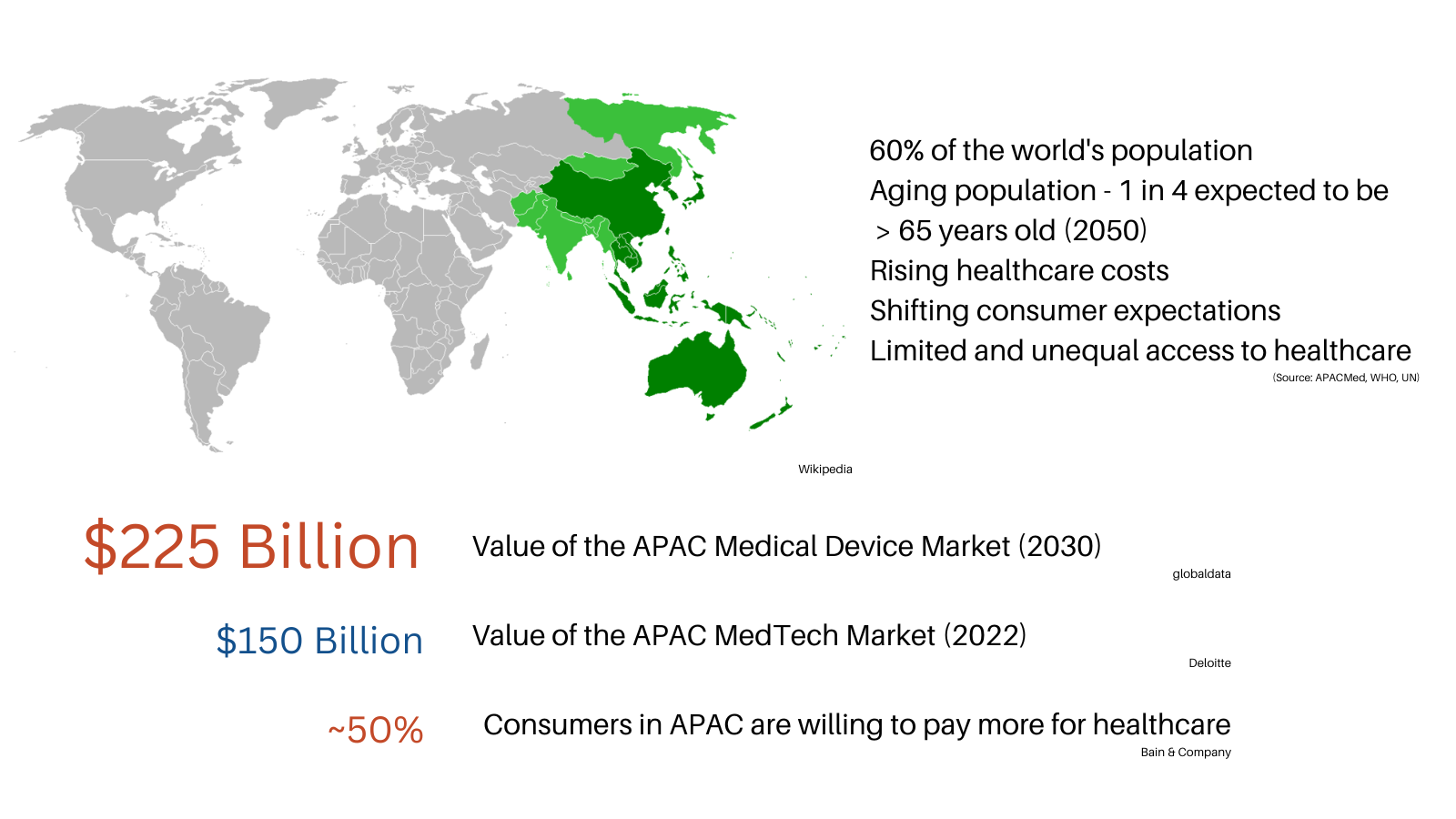

The growth of the Medical Device market in Asia-Pacific region

A significant growth of the Medical Device market in Asia-Pacific region in the coming years

According to a recent report, the Asia-Pacific (APAC) medical device market is expected to grow at a CAGR of 4.4%, reaching over $225 billion by 2030. Hospital supplies, holding a 43% market share, will remain the dominant segment, with growth driven by demand for personal protective equipment (PPE) and operating room equipment.

The expansion of the APAC hospital supplies market is driven by rising surgical rates, an ageing population, technological advancements, and increased patient awareness of workplace safety. The broader medical device market is growing due to the rise in routine medical examinations, technical innovations, and a surge in demand for minimally invasive treatments, supported by strong government investment in R&D for advanced devices.

As one of the top nations in the Asia-Pacific that uses cutting-edge medical equipment for both illness screening and treatment, China is predicted to dominate the market for medical devices in the region. According to trade.gov, China’s medical device market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.3% from 2021 to 2026, reaching $48.8 billion. About 75% of China’s market for medical device imports were made up of American providers, who accounted for 27.2% of China’s $5.62 billion worth of medical device imports in 2021.

The growth of MedTech sector

A fast growing sector within the medical device market is MedTech. MedTech, or Medical Technology, is defined as a field that takes into consideration the technology, or equipment, that the healthcare systems use for patient care, diagnosis, treatment, and health improvement. Asia-Pacific is the third-largest medtech market in the world, accounting for more than 22% of worldwide sales, according to research by McKinsey & Company, with a market value of US$88 billion (2016). The APAC MedTech sector was anticipated to reach 157 billion USD in value in 2022, growing at a CAGR of 8.8%. According to the China Association for Medical Devices Industry (CAMDI), China is the second-largest market in the world for medical devices and has been expanding at a CAGR of 20% since 2009.

However, based on research done by McKinsey with 150 senior executives from 30 leading MedTech companies in Asia-Pacific, they are facing a number of challenges in expanding their businesses. Challenges include intense competition from local start-ups and global industry leaders, limited financial resources, diverse customer segments, underdeveloped medical infrastructure, and a fragmented regulatory and reimbursement landscape, all of which hinder the efficient adoption of new technology. As APAC presently makes up around 37% of global GDP, with GDP rising from USD 9 trillion in 2000 to USD 35 trillion in 2021, and projected to reach nearly 42% of global GDP by 2040, the demand for a developed MedTech sector in the region remains attractive. Global MedTech companies must adapt their strategies, focusing on innovative products, new business models, local autonomy, and overcoming structural barriers to remain competitive.

The fast-changing socioeconomic problems

The increased average life expectancy, along with a falling fertility rate is worsening the ageing population situation in APAC, creating opportunities for players in the medical device industry. According to UNFPA, around 4.3 billion people currently live in the Asia and Pacific area, which also contains the world’s two most populous nations, China and India, meaning the region is home to 60% of the world’s population. Additionally, the number of population in the region 60 years and older will more than quadruple by 2050, reaching 1.3 billion. Based on a report, healthcare expenses for the elderly are projected to rise five-fold in APAC from US$500 billion in 2015 to US$2.5 trillion in 2030. Given the region’s ageing pattern, the expense of healthcare will total US$20 trillion between 2015 and 2030, with a 71% rise in healthcare demand and the growth of medical costs are the main cost drivers. With the growing ageing population in APAC, there is expected to be a surge in the demands for assistive devices, for example hearing implants, or demands for more home-care devices, wearable devices or remote monitoring.

The Covid-19 outbreak led to a surge in demand for personal protective equipment, ventilators, and other critical medical devices, while elective and non-essential procedures were delayed or cancelled, particularly during the peak months of March to April 2020. By 2021, many device markets had recovered, with some experiencing growth. Medical devices such as testing reagents, masks, protective gowns, ventilators, and thermometers continued to see strong local demand and expanded global supply.

The medical device market in APAC is unique due to significant differences between developed and emerging markets. For example, Japan attracts life sciences businesses due to its reimbursement coverage and advanced healthcare infrastructure. China’s rapidly changing market requires tailored marketing strategies for innovative and generic products, with some companies opting for local partnerships. In contrast, Southeast Asian nations like the Philippines, Vietnam, and Indonesia are implementing universal healthcare, offering potential growth opportunities for novel therapeutics and branded generics.

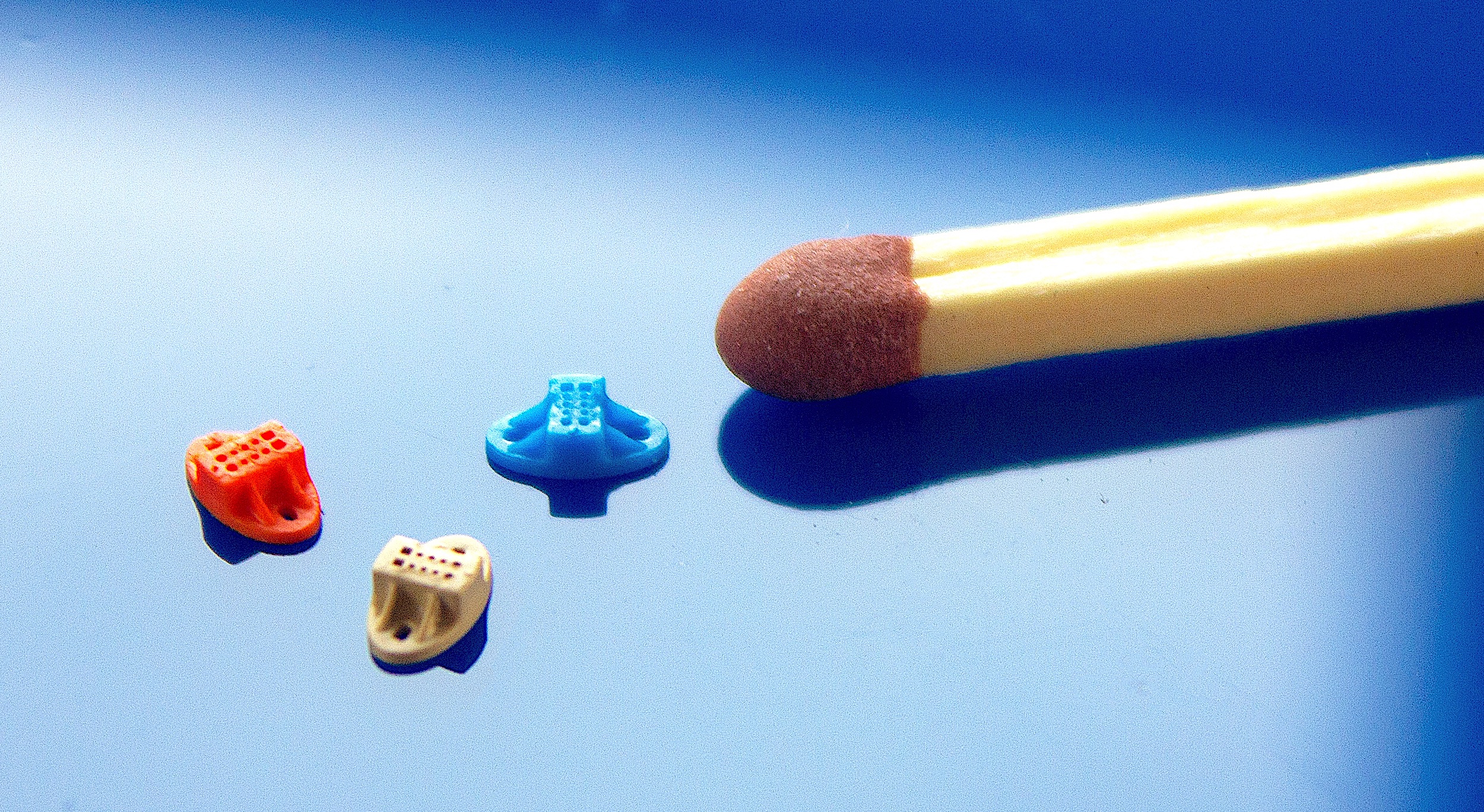

Our team of experts at Micro Systems Singapore has years of experience in providing turn-key services for moulding projects for the medical, pharmaceutical and optical markets for clients in the Asia Pacific region. Come visit us in the coming Medical Fair 2023 in Thailand where we will showcase our best practices in medical mould, medical devices and microfluidics.

Our team of experts at Micro Systems Singapore has years of experience in providing turn-key services for moulding projects for the medical, pharmaceutical and optical markets for clients in the Asia Pacific region. Come visit us in the coming Medical Fair 2023 in Thailand where we will showcase our best practices in medical mould, medical devices and microfluidics.

Date: 13 – 15 September, 2023

Location: Booth S17. Bangkok International Trade & Exhibition Centre (BITEC), Bangkok, Thailand

Micro Systems specialises in the design, manufacture and validation of ultra precision micro moulds for the medical, pharmaceutical and optical markets, at the same time, the development and use of micro and nano technologies in the design and manufacture of injection moulded components. We have a dedicated micro moulding facility, and have ISO13485 and ISO9001 certifications. For more information, please Contact us or visit our website.